Service Provided

How we work for exporter & importers

CT International finance method of trade finance that allows exporters to obtain cash by selling their medium and long-term foreign accounts receivable at a discount on a “without recourse” basis. A CT International finance is a specialized finance firm or a department worked with a bank that performs non-recourse export financing through the purchase of medium and long-term trade receivables. “Without recourse” or “non-recourse” means that the CT International finance assumes and accepts the risk of non-payment.

Similar to factoring, virtually eliminates the risk of non-payment, once the goods have been delivered to the foreign buyer in accordance with the terms of sale. However, unlike factors, CT International finance typically work with exporters who sell capital goods and commodities, or engage in large projects and therefore need to offer extended credit periods from 180 days to seven years or more. In CT International finance, receivables are normally guaranteed by the importer’s bank, which allows the exporter to take the transaction off the balance sheet to enhance key financial ratios. The current minimum transaction size for CT International finance is $500,000.

In the United States, most users of CT International finance are large established corporations, but small and medium-size companies are slowly embracing CT International finance as they become more aggressive in seeking financing solutions for exports to countries considered high risk.

Characteristics of CT International finance:

Applicability |

Suited for exports of capital goods, commodities, and large projects on medium and long-term credit (180 days to seven years or more) |

Risk |

Risk of non-payment inherent in an export sale is virtually eliminated |

Pros |

|

Cons |

|

Key Points:

- CT International finance eliminates virtually all risk to the exporter, with 100 percent financing of contract value.

- Exporters can offer medium and long-term financing in markets where the credit risk would otherwise be too high.

- CT International finance generally works with bills of exchange, promissory notes, or a letter of credit.

- In most cases, the foreign buyers must provide a bank guarantee in the form of a Letter of Credit.

- Financing can be arranged on a one-shot basis in any of the major currencies, usually at a fixed interest rate, but a floating rate option is also available.

- CT International finance can be used in conjunction with officially supported credits backed by export credit agencies such as the Bank.

How CT International Finance Works?

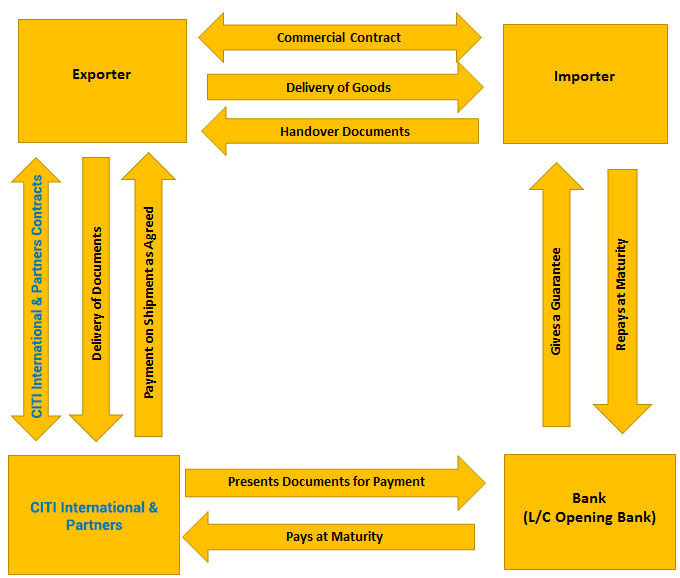

The exporter approaches a CT International finance before finalizing the transaction’s structure. Once the CT International finance commits to the deal and sets the discount rate, the exporter can incorporate the discount into the selling price. The exporter then accepts a commitment issued by the CT International finance & Partners, signs the contract with the importer, and obtains, if required, a guarantee from the importer’s bank that provides the documents required to complete the CT International finance.

The exporter delivers the goods to the importer and delivers the documents to the CT International finance who verifies them and pays for them as agreed in the commitment. Since this payment is without recourse, the exporter has no further interest in the financial aspects of the transaction and it is the CT International finance & Partners who must collect the future payments due from the importer.

When to Contact a CT International finance

CT International finance is widely used by exporters and financial institutions throughout Europe because their sales and financing professionals work very closely together to develop a contract price proposal that makes the cost of financing competitive and attractive to foreign buyers, an approach not widely embraced and practiced in the United States. Thus, exporters should contact a CT International finance at the earliest possible point in formulating their sales and financing proposals so that they might better understand the subtleties and complexities of dealing in certain markets, including how to create a medium-term financing proposal at interest rates that are competitive, without reducing the margin on the sale.

Cost of CT International finance

The cost of CT International Finance to the exporter is determined by the rate of discount based on the aggregate of the LIBOR (London inter bank offered rate) rates for the tenor of the receivables and a margin reflecting the risk being sold. In addition, there are certain costs that are borne by the importer that the exporter should also take into consideration. The degree of risk varies based on the importing country, the length of the loan, the currency of the transaction, and the repayment structure–the higher the risk, the higher the margin and therefore, the discount rate. However, CT International Finance can be more cost-effective than traditional trade finance tools because of the many attractive benefits it offers to the exporter.

Three Additional Major Advantages of CT International finance:

Volume

CT International finance can work on a one-off transaction basis, without requiring an ongoing volume of business.

Speed:

Commitments can be issued within hours or days depending on details and country.

Simplicity:

Documentation is usually simple, concise, and straightforward.